Fight Poverty with Financial Literacy!

Saturday, September 4, 2010

Saturday, August 28, 2010

Understanding Microfinance

What is microfinance?

Microfinance is the provision of a broad range of financial services to the poor and low-income households and their micro-enterprises (with P3M in assets or less).

How is BSP involved in microfinance?

The General Banking Law mandates BSP to set the rules for its practice in the banking sector. It is BSP ’s flagship anti-poverty program.

What microfinance services do banks usually offer?

Banks with microfinance operations typically grant loans and accept deposits.

Is there demand for other microfinance services?

As the microfinance industry develops, there is demand from clients for a wider range of services. It has been

proven that various financial services may be delivered sustainably through microfinance.

Aside from loans and savings, what microfinance services may banks offer?

BSP now allows eligible banks to come up with and offer their own housing microfinance and micro-agri loans; and to market, sell and service the microinsurance products of licensed insurance providers.

What is housing microfinance?

Housing microfinance applies microfinance principles (cash flow-based, frequent amortization, collateral-free,

etc.) to the provision of housing loans.

Who are qualified for housing microfinance?

• Existing MFI clients

• New clients normally eligible for microfinance loans based on banks’ policies

• Borrowers qualified for the Credit Surety Fund, a program for small businesses to obtain bank credit

For what purposes may the housing loan be used?

The loan should be used to build a house; acquire a lot or house and lot; or for home improvement or repair.

The acquired lot may be used for business.

How much is the microfinance housing loan?

Clients may get up to P300,000 for house construction and/or lot acquisition and up to P150,000 for home improvement or repair.

What are the terms of payment? Clients may pay up to 15 years for house construction and house and lot acquisition and up to five years for

improvement and repair.

What are micro-agri loans? Micro-agri loans are credit for small farming activities.

Who may obtain a micro-agri loan?

The loan is for an existing microfinance borrower engaged in a farm activity for two years or more. For risk

management, the borrower must have an off-farm livelihood activity to ensure payment amid agricultural seasonality.

For what activities may the micro-agri loan be used?

The loan may be used for farm activities, agri-business and agri-related fixed assets, among others.

What is the amount of the micro-agri loan?

The loan may reach P150,000. Loans start small and increase in succeeding loans.

What is the term of payment?

The loan term is up to 12 months.

What is microinsurance? It is an activity providing specific insurance, insurance-like and other similar products and services that meet

the needs of the low-income sector for risk protection and relief against distress, misfortune and other events.

How much would clients pay for insurance? Premiums, contributions, fees or charges—computed on a daily basis—do not exceed five percent of the current daily minimum wage for non-agricultural workers in Metro Manila.

What is the maximum benefit amount? The maximum sum of guaranteed benefits may reach up to 500 times the daily minimum wage rate for nonagricultural workers in Metro Manila.

What institutions provide microinsurance? Insurance companies, cooperative insurance societies, and mutual benefit associations licensed by the Insurance Commission may provide this service. Banks may market, sell and service the microinsurance products of these institutions, provided they meet BSP requirements.

For the list of banks with microfinance functions, click here.

Friday, August 27, 2010

Thursday, August 26, 2010

Trust Fund Investing

UNIT INVESTMENT TRUST FUNDS ALLOW RETAIL INVESTORS TO PARTICIPATE IN LARGE FUND INVESTING THAT IS OTHERWISE INACCESSIBLE TO THEM.

Unit invest trust funds (UITFs) are the sophisticated form of paluwagan, the investment that doubles as a savings plan many Filipinos as familiar with. Ma. Elizabeth Aquino, assistant vice-president and trust officer of East West Banking Corp., describes a UITF as "a collective investment scheme that pools the investments of small investors into a larger fund under professional management. It is able to access more superior investment opportunities not normally available to individual retail investors."

This kind of trust fund comes with a number of advantages. One is the low minimum investment required, which starts at P10,000. Another is that one need not be a finance expert to make an investment. Because the money is pooled, investors diversify their portfolio and minimize their risks. The fund determines the best way to park the money, whether it be in commercial paper, bonds or equities.

Ador Abrogena, executive vice-president of Banco de Oro (BDO) trust banking group, says UITFs are perfect for people with no time to study securities. Investors can choose from a wide variety of UITFs that suit their risk appetite. UITFs vary depending on the securities these are invested in. Some are placed only in bonds, some only in stocks, some only in government securities, while others are in various instruments to be more "balanced." These funds may either be peso-or dollar-denominated.

Another advantage to investing in UITFs is the ease of joining and leaving the fund. "As it is an open-pooled fund, investors can freely join or withdraw their investment participation as often as allowed under the UITF plan rules," says Aquino. UITFs are available in participating banks almost everyday, with fees ranging from 0.5 to 2.5 percent per annum of the fund. The UITF works much like a mutual fund. "Investors share in the gains or losses proportionate to their respective participation in the pool," she says.

Investors' participation is valued using the Net Asset Value Per Unit (NAVPU), which is market-determined and computed using the daily mark-to-market valuation of net assets divided by the number of outstanding units. Abrogena says the fund's risk lies in this method, because it causes the NAVPU to fluctuate everyday, making investments held by the fund to gain or lose on any given trading day.

A good example of this was the confluence of events last May, when investors, worried about the coup rumors, the dropping share values in the stock market, and the rising interest rates, redeem their participation in the UITFs. Many were also put off by the fact that the Philippine Deposit Insurance system does note cover this new investment vehicle.

Aquino says the investment run may have been due to product misunderstanding or misperception. East West and other banks tried to stand these withdrawals by informing their clients of market developments; the courses of action fund managers were taking for the UITF portfolio; and by doing and honest market forecasting for the rest of the year.

These efforts paid off as the NAUVPUs of East West Bank's unit investment trust funds recovered lost ground last June."In fact, our UITF's performance-where the historical year-on-year and year-to-date yields are among the highest in the fixed-income UITFs-can attest to this" she says.

Aquino advises investors who want to fully appreciate the earning potential of these funds to stick to it longer to allow them to ride out market corrections. Abrogena says UITFs are good long-term investments. "The real value of UITFs in in providing better returns over the long term by allowing investors to take risks according to their own risk tolerance in a vehicle that allows for utmost convenience, safeguarded by sound regulations, and managed by full-time investment professionals."

CHOOSE YOUR FUND

The type of unit investment trust funds (UITFs) depends on the investments they make. Here are some UITFs in the market today:

1. Money market securities UITFs. These are low risk, high liquidity investments.

* East West Bank's Peso Trust Maximizer and Dollar Trust Maximizer.

Investments are made in goverment bonds and deposits.

Minimum investments are P100,000 for peso UITFs and $2,000 for dollar UITFs.

* BDO Peso Money Market Fund and Dollar Money Market Fund.

Investments are made in low-risk, fixed-income securities with a portfolio wighted average life of not more

than one year. Minimum investments are P100,000 for peso UITFs and $2,000 for dollar UITFs.

* BDO Fixed-Income Fund. Investments are made in short-and long-term fixed income securities. Minimum

investment is P10,000.

2. Bond UITFs. These entail more risks but promise higher returns in the long term.

* BDO Peso Bond Fund and Dollar Bond Fund. Investment are made in bonds and similar fixed-income

securities with a portfolio weighted average life or more than one year. Minimum investments are P100,000

for peso UITFs and $2,000 for dollar UITFs.

3. Balanced UITF. Like bond UITFs, balanced unit investment trust fund are more risky, but promise higher returns.

* BDO Balanced Fund. Investments are made in equities and fixed income securities. Minimum investment is

P10,000.

BANCO DE ORO

Telephone (02)702-6000

EAST WEST BANK

Telephone (02)815-0233

Wednesday, August 25, 2010

Investment Terms Simplified

EAGER TO PLAY IN THE MONEY MARKET BUT STILL LOST IN THE MISHMASH OF FINANCIAL JARGONS? BELOW ARE SOME INVESTMENT CONCEPTS SIMPLIFIED:

Appreciation vs. Depreciation

Appreciation is the increase in value of assets over time while depreciation refers to its decline. Buildings and equipment normally depreciate due to wear and tear while real estate and other assets may increase their value depending on their location, condition, or economic situation.

Asset Allocation

This refers to the method of deciding how much money to invest in which investment vehicle (e.g. stocks, bonds, mutual funds, etc.) to maximize earning.

Diversification

It's strategy where an investor puts money in several kinds of businesses or securities to protect his investment in case the market suffers a downturn. This could be a mix of shares in the stock market, mutual fund and government securities like bonds and treasury bills.

Dividends

Dividends are earnings distributed by publicly listed companies among its stockholders. The amount is in proportion to the number of shares held by the stockbroker, paid either annually, semi-annually, or quarterly. Dividends may take the form of cash, stocks, or property.

Fund Manager

Refers to a person who advises or helps manage an investor's portfolio. Some financial institutions provide professional fund managers to clients as part of their investment package.

Inflation

Refers to the increase in the prices of commodities in relation to the capacity of people to purchase such goods - it is said that money may no longer be able to buy in the future what it can afford today. Higher inflation rate diminishes the ability of the investment to yield higher returns. If the inflation rate is a 3.5% and your investment is earning you less than that, you're basically losing money.

Interest

There are basically two types: the simple interest, where the base for computing interest is the original amount he invested or borrowed; and the compound interest, where the base to compute interest accumulation changes as the investment grows. Compound interest works better for investments as it makes money grow more quickly, while it does the opposite for loans and debts.

Liquidity

Liquidity refers to how fast investments or other assets can be converted to cash. Investments in the stock market and mutual funds are normally considered liquid because they can easily be sold to the stockbroker or issuer, while real estate investments take a while to dispose of.

Mutual Fund

A type of investments where money of several investors are pooled together by a mutual fund company that buys and manages shares of stocks or securities on their behalf. This is ideal for investors who have little money, time, or expertise to monitor the performance of the investment.

Portfolio

A persons investment in stocks, securities, bonds, and treasury notes consists his portfolio-a term which refers to the investment collectively.

Principal

It is the amount an investor originally uses to buy securities or stock shares. It also refers to the value where simple interest rates are computed, and so is the amount paid for by the issuer of treasury notes and bills (usually the government) upon maturity.

Return on Investment

The return on investment is how long it takes to recover the amount of money an investor has put into a business or other money-vehicles-higher returns at lesser time is ideal.

Saving vs. Investing

Money allocated for savings and deposit accounts are normally set aside for future expenses or emergencies, while cash invested in stocks, securities, or bonds provides opportunities for money to grow over time. The major difference here is that investments usually require higher risk-you either lose money or make tons of it through higher interest rate and changing economy.

Stock Investing

Refers to buying shares of ownership in a publicly listed company, normally through a stockbroker or on-line trading through the internet. Investing money in a corporation can be riskier, but it can also be more profitable, as your returns can be anywhere from 20 to 30 percent.

Taxes

Earnings from investments are subject to taxes, but there are some (like mutual funds) that are exempted from it.

Term

It refers to the length of time your money has to be tied up to a deposit account or investment vehicle, which could either be for short, medium or long-term. Terms could indicate the investment's yield (e.g., for bonds, long terms may offer higher interest rates) while pre-termination (in time deposits, for example) may require you to pay a certain amount as penalty.

Time Deposits

This is where a bank depositor maintains an account with the minimum amount earning a fixed interest rate for a specific time. It is ideal for those who don't need their money immediately - money is tied up for at least 30 days (longer for some banks) but offer a higher interest rate of about five to six percent per annum. There is also the option of "rolling over" the amount, which means you just keep renewing the time deposit at the end of every period.

Treasury Bills

Treasury bills are similar to treasury notes, except that they require shorter term of 30 days to a year - and are risk-free since they carry the government's full and unconditional guarantee. Interest rates can go as high as four percent per annum.

Treasury Notes

Here, you loan your money to the Philippine government to finance public expenses. They require a longer investment - from two to 25 years - but you can enjoy coupon interest payments, usually handed out semi-annually, in arrears. Longer term equals a higher interest rate.

Trust Funds

When you enter into s trust fund, you are allowing your bank's investment managers to place your money in various securities (i.e. commercial papers, government loans) along with other investors. All gains are split among the individual investors. - Researched by Millet M. Enriquez and Katrina Tan

Source: Entrepreneur Philippines, June 2006 Issue

Monday, August 23, 2010

Sunday, August 22, 2010

Decode Your Paycheck

ALWAYS FACED WITH a bunch of confusing numbers and shocking deductions from your well-earned salary? Figure out your paycheck amidst the number jumble.

Payslips are more than a twice-a-month reminder of how much you’re earning. Besides stating your salary for that payroll period, it also contains other income not included in your basic monthly salary (such as unused vacation leaves and the like), deductions that are dependent on company policy and deductions that are mandated by the Philippine government (such as Philhealth, Social Security System, and Pag-IBIG contributions).

“Your payslip may also be used as documentation when applying for loans or credit accommodation, insurance, and other purposes where proof of income is required,” adds Pinky Belizario, a human resources consultant for various companies like Globe Telecom and ABN Amro Bank.

WHAT ARE THE COMPONENTS OF A PAYSLIP?

- Basic gross pay for the payroll period

- Overtime pay

- Vacation and sick leaves

- Thirteenth month pay (if included in that month)

- Bonuses (if any)

- Deductions

- Philippine Health Insurance (Philhealth) contribution

- Social Security System (SSS) contribution

- Pag-IBIG (Pagtutulungan sa kinabukasan: Ikaw, Bangko, Industriya at Gobyerno) Fund contribution

- Loan payments (if any)

- Withholding tax (by the start of the year)

- Deductions resulting in company policy (i.e., stock option payments, company loans, union dues, etc.)

GOVERNMENT-MANDATED MINUSES

“A member of any of these government programs can be assured of financial benefits arising from possible events that result from loss of income,” says Belizario. “Opportunities to avail of housing, medical and financial aid are open to members, provided that proper contributions and eligibility requirements are complied with.”

1. Pag-IBIG Membership. If you’re a Filipino or Filipino citizen earning P4,000 and above a month, you automatically become a Pag-IBIG member. Membership may also be voluntary for self-employed individuals, non-working spouses, overseas Filipino workers, and Filipino residents in Canada and USA.

While being a member of Pag-IBIG is usually associated with housing loans, it also offers savings benefits and short-term loans. Only those that have been Pag-IBIG member for 24 months may avail of the loans and benefits.

2. Philhealth Membership. Every employee is mandated to join Philhealth through his employer. Philhealth provides financial assistance for medical emergencies. Membership is also extended to the following: self-employed individuals, retirees and pensioners of the Government Service Insurance System (GSIS) and SSS, retirees, and members who have reached the retirement age. Other eligible members are dependents, such as non-member legitimates spouses, children below 21 years old who are unmarried and unemployed, and parents 60 years old and above.

The amount deducted by Philhealth is the first to be used up during a medical emergency. This includes both in-patient and out-patient hospital care. For confinement, you must have paid at least three consecutive contributions prior to your confinement to avail of the benefit.

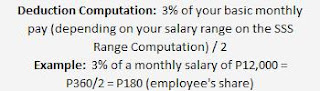

3. SSS Membership. According to the SSS Guidebook, SSS membership is compulsory for the following Filipinos: a private employee who is 60 years old and below, a household-helper earning at least P1,000, seafarers, foreign government employees, a parent, spouse or child below 21 years of the owner of the owner of a single proprietorship business, and self-employed individuals.

The wide range of SSS benefits and loans mainly covers the following points: In case of death, sickness, disability, maternity. In other cases wherein the loss of income might occur, SSS is of service to help out its members.

WHAT ABOUT LEAVES?

Depending on your company’s policy, unused leaves (sick, service, service incentive, vacation, etc.) are computed differently.

“Unused leaves are generally converted into its cash value. It differs from company to company as sometimes, a limit is set for the allowable converted days or may be subject to forfeiture, if unavailed,” says Belizario. “Service incentive leave, on the other hand, is a legal benefit, and may only be available after a service of one year with the company. It’s converted the same way as the rest of the leaves.”

The list of unused leaves is usually stated on your paycheck, so it’s best to keep track of this. It’s important to note when your leaves would be forfeited or converted to cash.

Source: Good Housekeeping, July 2008 Issue

Subscribe to:

Posts (Atom)