ALWAYS FACED WITH a bunch of confusing numbers and shocking deductions from your well-earned salary? Figure out your paycheck amidst the number jumble.

Payslips are more than a twice-a-month reminder of how much you’re earning. Besides stating your salary for that payroll period, it also contains other income not included in your basic monthly salary (such as unused vacation leaves and the like), deductions that are dependent on company policy and deductions that are mandated by the Philippine government (such as Philhealth, Social Security System, and Pag-IBIG contributions).

“Your payslip may also be used as documentation when applying for loans or credit accommodation, insurance, and other purposes where proof of income is required,” adds Pinky Belizario, a human resources consultant for various companies like Globe Telecom and ABN Amro Bank.

WHAT ARE THE COMPONENTS OF A PAYSLIP?

- Basic gross pay for the payroll period

- Overtime pay

- Vacation and sick leaves

- Thirteenth month pay (if included in that month)

- Bonuses (if any)

- Deductions

- Philippine Health Insurance (Philhealth) contribution

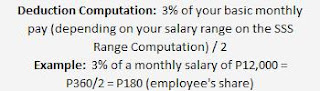

- Social Security System (SSS) contribution

- Pag-IBIG (Pagtutulungan sa kinabukasan: Ikaw, Bangko, Industriya at Gobyerno) Fund contribution

- Loan payments (if any)

- Withholding tax (by the start of the year)

- Deductions resulting in company policy (i.e., stock option payments, company loans, union dues, etc.)

GOVERNMENT-MANDATED MINUSES

“A member of any of these government programs can be assured of financial benefits arising from possible events that result from loss of income,” says Belizario. “Opportunities to avail of housing, medical and financial aid are open to members, provided that proper contributions and eligibility requirements are complied with.”

1. Pag-IBIG Membership. If you’re a Filipino or Filipino citizen earning P4,000 and above a month, you automatically become a Pag-IBIG member. Membership may also be voluntary for self-employed individuals, non-working spouses, overseas Filipino workers, and Filipino residents in Canada and USA.

While being a member of Pag-IBIG is usually associated with housing loans, it also offers savings benefits and short-term loans. Only those that have been Pag-IBIG member for 24 months may avail of the loans and benefits.

2. Philhealth Membership. Every employee is mandated to join Philhealth through his employer. Philhealth provides financial assistance for medical emergencies. Membership is also extended to the following: self-employed individuals, retirees and pensioners of the Government Service Insurance System (GSIS) and SSS, retirees, and members who have reached the retirement age. Other eligible members are dependents, such as non-member legitimates spouses, children below 21 years old who are unmarried and unemployed, and parents 60 years old and above.

The amount deducted by Philhealth is the first to be used up during a medical emergency. This includes both in-patient and out-patient hospital care. For confinement, you must have paid at least three consecutive contributions prior to your confinement to avail of the benefit.

3. SSS Membership. According to the SSS Guidebook, SSS membership is compulsory for the following Filipinos: a private employee who is 60 years old and below, a household-helper earning at least P1,000, seafarers, foreign government employees, a parent, spouse or child below 21 years of the owner of the owner of a single proprietorship business, and self-employed individuals.

The wide range of SSS benefits and loans mainly covers the following points: In case of death, sickness, disability, maternity. In other cases wherein the loss of income might occur, SSS is of service to help out its members.

WHAT ABOUT LEAVES?

Depending on your company’s policy, unused leaves (sick, service, service incentive, vacation, etc.) are computed differently.

“Unused leaves are generally converted into its cash value. It differs from company to company as sometimes, a limit is set for the allowable converted days or may be subject to forfeiture, if unavailed,” says Belizario. “Service incentive leave, on the other hand, is a legal benefit, and may only be available after a service of one year with the company. It’s converted the same way as the rest of the leaves.”

The list of unused leaves is usually stated on your paycheck, so it’s best to keep track of this. It’s important to note when your leaves would be forfeited or converted to cash.

Source: Good Housekeeping, July 2008 Issue

I have recently started a blog, the info you provide on this site has helped me greatly. Thanksfor all of your time & work. Paycheck loan

ReplyDelete